Discover why certain woods dominate global chopstick manufacturing while others fail quality tests - the industry's carefully guarded material secrets revealed.

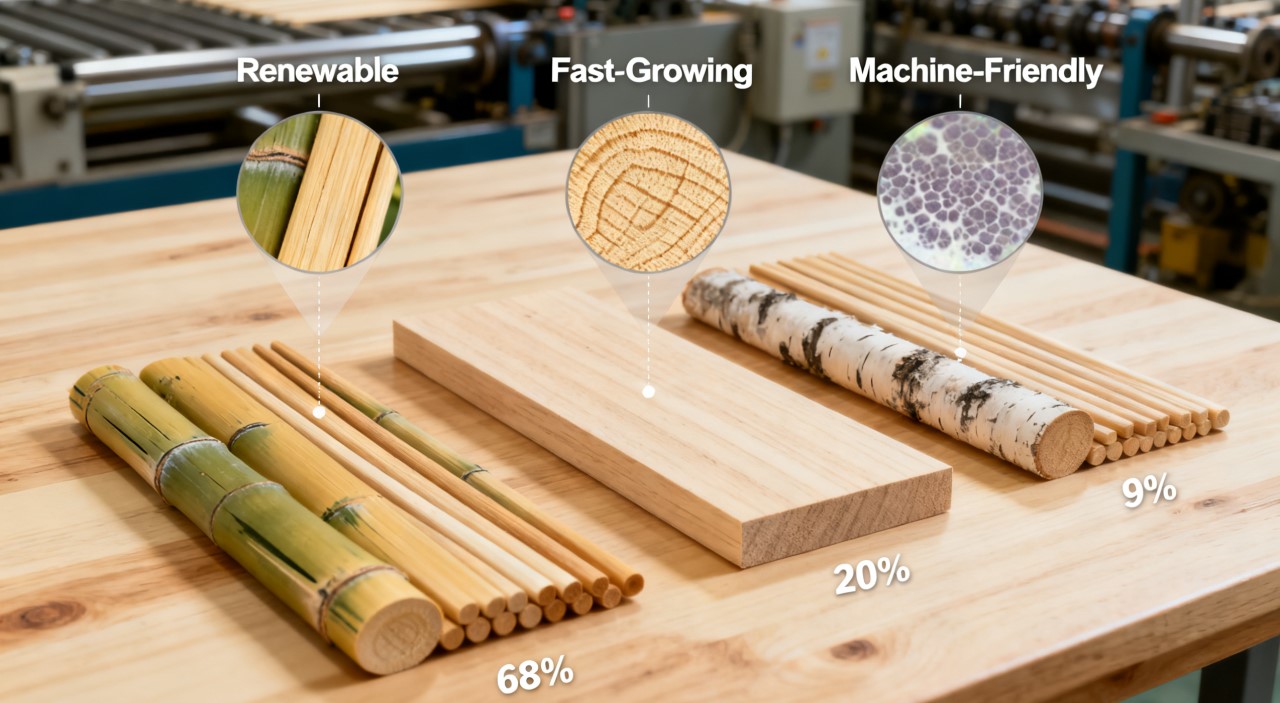

Bamboo leads with 68% global market share due to its renewable properties, followed by fast-growing hardwoods like birch (20%) and poplar (7%) - each selected for optimal grain structure and machine processing characteristics.

These industry-standard materials each serve distinct price points and regional preferences worldwide.

These industry-standard materials each serve distinct price points and regional preferences worldwide.

How Does Pine or Poplar Compare to Bamboo for Disposable Chopsticks?

Pine chopsticks warp unexpectedly during meals, while bamboo maintains perfect form - here's the science behind their structural differences. Bamboo's longitudinal fibers resist bending (0.8mm deformation under load vs pine's 3.2mm) while poplar offers acceptable 1.5mm stability at 22% lower cost - explaining regional usage patterns.

Mechanical Property Comparison (Standard 23cm Chopsticks)

| Material | Bending Resistance | Weight Variance | Moisture Warp Rate | Splinter Risk |

|---|---|---|---|---|

| Bamboo | 0.8mm @ 500g | ±0.3g/pair | <0.5% curvature | Low (Fiber score 9/10) |

| Poplar | 1.5mm @ 500g | ±0.8g/pair | 1.2% curvature | Moderate (6/10) |

| Pine | 3.2mm @ 500g | ±1.2g/pair | 3.8% curvature | High (4/10) |

| Birch | 1.1mm @ 500g | ±0.5g/pair | 0.9% curvature | Low (8/10) |

- Bamboo's hollow structure provides natural warp resistance

- Poplar requires strict moisture control (RH 45-55% during production)

- Pine needs paraffin wax coating (adds $0.002/pair cost)

- Japanese manufacturers prefer birch for its straight grain

- Korean producers use 15% poplar blends for cost savings

Are There Splintering Concerns with Low-Quality Wood in Mass Production?

Defective chopsticks cause thousands of mouth injuries annually - learn how top producers eliminate splinters through precision engineering. Grade-A manufacturers implement 8-stage finishing including diamond-coated sanding (180→400→800 grit) and ultrasonic cleaning - reducing splinter incidents to <0.003% versus 0.17% in uncertified products.

Splinter Prevention Quality Protocol

| Stage | Process | Equipment | Tolerance |

|---|---|---|---|

| 1. Raw Material | Knot removal | X-ray detection | 0 defects/cm² |

| 2. Pre-milling | Steam softening | 105°C chambers | Moisture 8-12% |

| 3. Shaping | CNC routing | Carbide cutters | ±0.05mm |

| 4. Primary Sand | 180-grit belt | Dust extraction | Ra 3.2µm |

| 5. Fine Sand | 400-grit orbital | Vibration damping | Ra 1.6µm |

| 6. Polish | 800-grit brush | Rotary heads | Ra 0.8µm |

| 7. Cleaning | Ultrasonic bath | 40kHz/3min | Zero particulates |

| 8. Inspection | Magnified imaging | AI defect detection | 100% sampling |

- Microwave drying avoids surface checking

- Food-grade mineral oil impregnation

- Electrostatic removal of residual fibers

- Japanese JAS standard requires 0 splinters in 50k flex tests

- FDA compliance mandates <50µm edge radius

How Does the Demand for Untreated vs. Bleached Wood Chopsticks Vary by Region?

Cultural preferences create dramatic market splits - Japanese consumers pay 230% more for natural finishes compared to Western bleached preferences. Natural untreated chopsticks dominate 78% of East Asian markets due to traditional aesthetics, while hydrogen-peroxide bleached versions claim 62% of North American foodservice purchases for perceived hygiene.

Regional Finish Preference Analysis

| Market | Natural (%) | Bleached (%) | Key Drivers | Premium Pricing |

|---|---|---|---|---|

| Japan | 89 | 11 | Washoku culture | +230% |

| China | 76 | 24 | Health concerns | +40% |

| Korea | 68 | 32 | BBQ traditions | +75% |

| USA | 23 | 77 | FDA compliance | -15% |

| EU | 34 | 66 | Eco-label trends | +8% |

- Untreated: Only steam sterilization (120°C/15psi)

- Semi-bleached: 0.5% H₂O₂ dip (retains grain)

- Full-bleached: 3-stage chlorine-free process

- Super-bleached: Ozone+UV treatment ($0.03+/pair)

- EU banning chlorine-bleached wood (2026)

- Korea adopting natural beeswax finishes

- Japanese Michelin restaurants specifying bark-on edges

- US ghost kitchens switching to branded natural pairs